Monday, 2 November 2015

Saturday, 31 October 2015

Key elements to decode the Price Order Flow

When it comes to decoding order flow’s there are 3 things traders need to know from an Institutional perspective to trade with the Institutions, instead of against them

1. Trade Location - Where the institutions are most aggressively buying and selling

2. Order Flow - How to follow the institutions as they buy and sell.

3. Trade Management - How to reduce Risk and boost profits while trading with the institutions.

Courtesy - Troy Epperson

1. Trade Location - Where the institutions are most aggressively buying and selling

2. Order Flow - How to follow the institutions as they buy and sell.

3. Trade Management - How to reduce Risk and boost profits while trading with the institutions.

Courtesy - Troy Epperson

Friday, 30 October 2015

Thursday, 29 October 2015

Friday, 23 October 2015

Tuesday, 20 October 2015

Sunday, 18 October 2015

Saturday, 17 October 2015

Understand the Order flow Trading

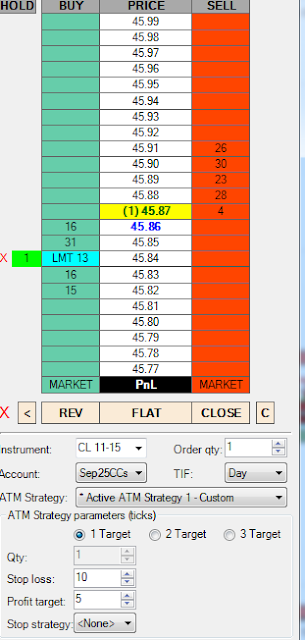

we must first understand why the price moves. Below is a picture of the DOM. The price ladder is the breakdown of resting limit orders between 5 levels indicative buyers (Green) and 5 levels indicative sellers (Red). The price level is marked yellow is the last price paid. In the parentheses, the number of contracts last traded. By reading the flow of orders we are trying to draw attention to shifts in the balance between buyers and sellers, and at an early stage to position ourselves before those who only follow the price, and various price-based indicators, ie majority. Order flow trader trying These forecasts rich no a few seconds ahead, so the method is primarily of interest to intraday speculators

Directional Trading Vs Order Flow Trading - Professional Trade Support by NinjaTrader

Directional Trading Vs Order Flow Trading :

How to define Directional trades meaning that you are going long or short, betting that prices will either move up or down. Therefore if you believe a stocks or commodity will go up, you execute a buy order. If you believe a stocks or commodity will fall, you can sell it, aka “going short.” This type of trading is called directional trading. It is one of the most common forms of trading, that usually many people in the investment world, hedge fund world, and retail speculators engage

How to define Directional trades meaning that you are going long or short, betting that prices will either move up or down. Therefore if you believe a stocks or commodity will go up, you execute a buy order. If you believe a stocks or commodity will fall, you can sell it, aka “going short.” This type of trading is called directional trading. It is one of the most common forms of trading, that usually many people in the investment world, hedge fund world, and retail speculators engage

Order flow Trading and liquidity is the foundation of every market

Order flow Trading and liquidity is the foundation of every market :

Order Flow Trading is NOT technical analysis or fundamental analysis, although both of those certainly do play a part in order flow analysis. Why isn’t order flow trading technical or fundamental analysis? Because technical and fundamental analysis DO NOT always move the market.,because they do not always generate the necessary order flow to move the market. Sometimes they can move the market, and other times they cannot. Technical and fundamental analysis are NOT the foundation of every market. Order flow and liquidity is the foundation of every market.

Many people have experienced losing traders using both technical and fundamental analysis on various occasions. Why do those losses occur? They occur because during that particular trade your technical or fundamental (or both) analysis did not generate sufficient order flow to move price in the direction of your trade. Perhaps you placed a trade with a chart pattern and it failed. Or perhaps you placed a trade using fundamental analysis, but your stop loss was triggered before your fundamental analysis “kicked in” to move the market in your favor.

Order Flow trading seeks to correct the deficiencies in both technical and fundamental analysis – in order to come up with high probability trading based on the very foundations of every market – order flow and liquidity. It is the very best, and most profitable way to trade.

Order Flow Trading is NOT technical analysis or fundamental analysis, although both of those certainly do play a part in order flow analysis. Why isn’t order flow trading technical or fundamental analysis? Because technical and fundamental analysis DO NOT always move the market.,because they do not always generate the necessary order flow to move the market. Sometimes they can move the market, and other times they cannot. Technical and fundamental analysis are NOT the foundation of every market. Order flow and liquidity is the foundation of every market.

Many people have experienced losing traders using both technical and fundamental analysis on various occasions. Why do those losses occur? They occur because during that particular trade your technical or fundamental (or both) analysis did not generate sufficient order flow to move price in the direction of your trade. Perhaps you placed a trade with a chart pattern and it failed. Or perhaps you placed a trade using fundamental analysis, but your stop loss was triggered before your fundamental analysis “kicked in” to move the market in your favor.

Order Flow trading seeks to correct the deficiencies in both technical and fundamental analysis – in order to come up with high probability trading based on the very foundations of every market – order flow and liquidity. It is the very best, and most profitable way to trade.

Order flow Analysis Concept - Professional NinjaTrader Training to understand the concepts of Order flow Trading for Indian Futures Market

Order flow analysis.. It refers to how the orders are coming into the market, how they are being filled; whether executing at the offer or on the bid. It is the dual auction at the most micro-level. Assessing order flow in real time can tell the trader how trade is being facilitated in any direction, a key concept in auction market theory.

Friday, 16 October 2015

Thursday, 15 October 2015

Wednesday, 14 October 2015

Friday, 9 October 2015

Thursday, 8 October 2015

Friday, 3 July 2015

Tuesday, 30 June 2015

Wednesday, 24 June 2015

Tuesday, 23 June 2015

Friday, 19 June 2015

Wednesday, 17 June 2015

Subscribe to:

Comments (Atom)